#nifty backtesting

Explore tagged Tumblr posts

Text

#nifty50#nifty#banknifty#Backtesting#free backtesting#option backtesting#free option backtestng#nifty backtesting#nifty option backtesting#free nifty backtesting#optiontrading#option trading tips

0 notes

Text

nifty and bank nifty movers 23 jan 2024

#nifty50#nifty prediction#nifty fifty#bank nifty#nifty today#niftytrading#nifty index#backtesting#backtestmojo#Backtest#free Backtest

1 note

·

View note

Text

Discover the Best Algo Trading Software in India — AlgoSignal.ai. Powered by cutting-edge artificial intelligence, our platform delivers accurate, real-time trading signals for Nifty, Bank Nifty, and more. Whether you're a beginner or a pro trader, AlgoSignal.ai helps you trade smarter with zero emotions and 100% automation.

✅ Smart buy/sell signals

✅ Fully automated execution

✅ Emotion-free, stress-free trading

✅ Backtested strategies & consistent returns

Join thousands of traders using the most advanced AI-driven system in India.

Start your journey with AlgoSignal.ai today and take control of your financial future.

0 notes

Text

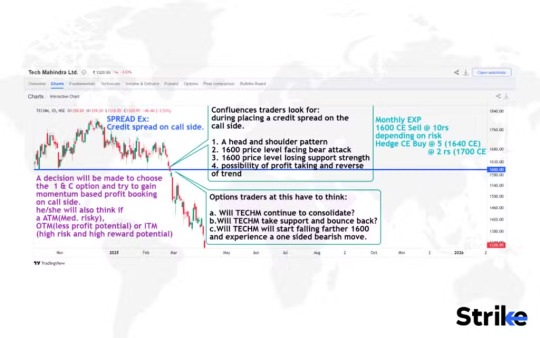

🧠 Complete Guide to Credit Spread: Smart Options Strategy for Profitable, Defined Risk Trading

The options market has exploded in popularity, especially with the rise of retail traders in India. Among dozens of complex strategies, the credit spread stands out as a smart, controlled-risk strategy for traders who want income with a hedge.

Whether you’re an experienced trader on NSE options, or just learning the ropes through tools like Strike Money, this guide walks you through everything—from how a credit spread works to real-world India-focused examples, payoff structures, and backtested results.

🤔 What is a Credit Spread in Options Trading?

A credit spread is a type of vertical options spread where you sell one option and buy another of the same expiry but different strike price. The result? You receive a net credit—hence the name.

⚡ Example: On Nifty 50, let’s say the index is at 22,500. You:

Sell a 22,400 PUT

Buy a 22,300 PUT

You receive a net premium of ₹45. This is your maximum potential profit, while your maximum loss is capped at ₹55 (difference in strikes – premium received). It's a defined risk strategy.

⚔️ Credit Spread vs Debit Spread – Know the Key Difference

While both use two options of the same type (calls or puts), the major difference lies in:

💵 Cash Flow: Credit spreads give you premium upfront, debit spreads cost you money.

📈 Probability of Profit: Credit spreads generally have a higher chance of profit but offer lower returns. Debit spreads need a stronger directional move to win.

📉 Risk Profile: Both are defined risk, but credit spreads are preferred by theta-positive traders who benefit from time decay.

Most Indian traders use credit spreads during range-bound or mildly trending markets, especially around weekly expiry on instruments like Bank Nifty and FINNIFTY.

🚀 Master the Two Types of Credit Spreads: Bull Put & Bear Call

🔼 Bull Put Spread – The Bullish Income Strategy

If you expect Nifty to stay above a support level, a bull put spread is ideal.

📍 Real Example: Suppose Nifty is at 22,500, and you believe it won't fall below 22,200. You:

Sell 22,300 PUT @ ₹60

Buy 22,200 PUT @ ₹20

👉 Net credit: ₹40 👉 Max loss: ₹60 👉 Breakeven: 22,260 👉 POP (Probability of Profit): 68% (based on Delta)

It’s a theta-positive, low-volatility strategy, best used when implied volatility (IV) is high and expected to fall.

🔽 Bear Call Spread – The Bearish Control Strategy

If you expect resistance to hold, use a bear call spread.

📍 Say Bank Nifty is at 48,000 and facing resistance at 48,500:

Sell 48,300 CALL @ ₹70

Buy 48,500 CALL @ ₹30

👉 Net credit: ₹40 👉 Max loss: ₹160 👉 Breakeven: 48,340 👉 Best in sideway markets post-earnings or RBI event

Strike Money’s IV charts and option chain overlays help identify the right strikes and IV levels.

📅 When Should You Deploy a Credit Spread?

Timing is everything.

⏰ Ideal time to enter a credit spread is:

7–10 days before expiry

IV Rank above 50

Delta of short leg around 20–30

Support or resistance confirmed by price action or indicators

India’s weekly options (especially on Nifty, Bank Nifty, and FinNifty) offer ideal setups with high liquidity and tight bid-ask spreads—both crucial for credit spread execution.

🛡️ Risk Management: Don’t Let Small Spreads Become Big Losses

Every trade has risk—but credit spreads offer you built-in insurance.

😨 Max loss happens only if the index breaches the long leg and expires beyond it.

🧠 Smart risk management tips:

Never hold till expiry if the trade is in danger

Use STOP LOSS on premium, e.g., exit if premium doubles

Roll the spread if direction changes

Use Strike Money alerts to get notified when your breakeven is approached

Many traders make the mistake of letting “high POP” fool them into complacency. But data from CBOE and Option Alpha shows that probability-based strategies still need active management.

🧮 How to Select the Right Strike Prices & Expirations

Your strike choice determines your success rate.

🎯 Ideal setup:

Short leg delta: 0.25–0.30

Spread width: 100–200 points (Nifty) or 200–300 (Bank Nifty)

DTE (Days to Expiration): 7–14 days for weekly spreads

Look for high open interest + volume

🔍 Use Strike Money’s Options Flow Scanner to find high-probability setups on stocks like Reliance, HDFC Bank, or ICICI Bank.

Data from OCC suggests that credit spreads with short legs in the 30-delta zone tend to deliver a 70–75% win rate, if risk is managed.

🧪 Are Credit Spreads Actually Profitable? Let’s Look at the Data

Let’s back it up with numbers.

According to a study by TastyTrade, credit spreads on the S&P 500 (similar in behavior to Nifty 50) with:

45 DTE

30 Delta short leg

1 SD width ...have delivered a 74% win rate over 10 years.

📈 On the Indian side, analysis of weekly Bank Nifty spreads from Jan–Apr 2024:

Strategy: Bull Put Spreads

Avg credit: ₹40

Win rate: 68%

Avg ROI: 9.3% per week

These strategies shine especially when combined with event-based setups like RBI policy, FED speech, or macro announcements.

🧰 Best Tools to Trade Credit Spreads in India

Your broker matters.

Most popular platforms:

Zerodha (low cost, but no execution spread orders)

Upstox

Fyers

Angel One

But what matters more is your analysis tool.

💻 Enter Strike Money—a growing charting and analysis platform tailored for Indian options traders:

Live Option Chain Analytics

IV Rank Tracker

Real-Time Breakout Alerts

Probability of Profit calculators

Multi-leg Strategy Builder

If you trade credit spreads without tracking volatility and real-time premiums, you're flying blind. Strike Money gives you the edge.

💥 Real-World Example: Credit Spread on Reliance Industries

Let’s say Reliance is trading at ₹2,900 and you anticipate range-bound behavior ahead of earnings.

You create a Bear Call Spread:

Sell ₹2,950 CALL @ ₹38

Buy ₹3,000 CALL @ ₹20

✅ Net credit: ₹18 ❌ Max loss: ₹32 🧮 ROI: 56.25% if Reliance stays below ₹2,950 at expiry

This setup would benefit from theta decay and falling IV post-earnings—a typical pattern observed in Indian stocks.

📢 FAQs About Credit Spreads in India

🧐 Is a credit spread bullish or bearish? Both. Use a bull put for bullish bias and bear call for bearish bias.

🧨 Can you lose more than you earn? Yes. Credit spreads have limited profit, but loss can be higher if poorly structured.

📈 Are credit spreads taxable? Yes, profits are considered business income under Indian tax laws, taxed as per slab.

🔍 Is it safer than a naked option? Absolutely. You always cap your risk with the long leg, avoiding margin calls.

📉 Is holding till expiry risky? Yes. Exercise risk, gamma spikes, and sudden IV changes can flip the trade. Exit when 70–80% profit is achieved.

🔚 Should You Trade Credit Spreads?

✅ If you:

Prefer defined risk

Thrive in range-bound markets

Want high probability setups

Use tools like Strike Money for smart entry and alerts

...then credit spreads are a solid strategy to add to your options playbook.

❗But remember: It's not “set and forget.” Monitor. Adjust. Respect the data.

🎯 Final Takeaway:

In the Indian options market, credit spreads provide a calculated way to generate consistent income while controlling risk. Backed by strong math, accessible instruments, and platforms like Strike Money, this strategy belongs in every serious trader’s arsenal.

💬 Ready to explore spreads? Use Strike Money’s multi-leg strategy builder today and start testing setups before going live.

0 notes

Text

Nifty Option Trading Strategies for Beginners in India

Mastering Nifty option trading strategies is a game-changer for students and beginners aiming to thrive in the Indian stock market. The Nifty 50 index, known for its liquidity and volatility, offers immense opportunities for options trading, but success requires skill and knowledge. Shaan Trade, a premier online institution, provides top-tier options trading courses tailored for learn Nifty trading enthusiasts, particularly students. These courses teach stock market options strategies specific to the Nifty index, making them ideal for Nifty trading beginners. In this detailed guide, we explore Shaan Trade’s approach, key Nifty option trading strategies, and how students can start their trading journey with confidence.

Why Students Should Learn Nifty Option Trading

Nifty options, based on the Nifty 50 index, are among the most traded derivatives in India due to their high liquidity and potential for significant returns. Options trading involves contracts that give the right, but not the obligation, to buy or sell the Nifty index at a specific price before a set date. For students, learn Nifty trading offers:

High Profit Potential: Leverage allows small investments to yield substantial gains.

Career Growth: Skills for roles like derivatives trader or market analyst.

Risk Management: Strategies like hedging minimize losses.

Financial Discipline: Builds habits for long-term wealth creation.

Shaan Trade’s options trading courses are designed for stock trading for beginners, offering flexible schedules and practical training to master Nifty option trading strategies in the Indian market.

What Makes Effective Nifty Option Trading Strategies?

Successful Nifty trading strategies depend on market conditions, risk appetite, and clear execution. Students should focus on strategies that are:

Beginner-Friendly: Simple to grasp with defined entry and exit points.

Tailored to Nifty: Leverage the index’s volatility and liquidity.

Risk-Conscious: Include stop-loss or hedging to protect capital.

Backtested: Validated through historical Nifty data for reliability.

Supported by Education: Taught through structured options trading courses with live market examples.

Shaan Trade’s courses emphasize these qualities, ensuring students master the Nifty option trading strategies needed for the Indian market.

Shaan Trade’s Nifty Options Trading Course: Your Path to Success

Shaan Trade’s "Nifty Options Trading Course" is a standout among options trading courses, crafted for learn Nifty trading beginners and students. It equips learners with the tools to trade Nifty options confidently.

Key Features:

Curriculum: Covers stock market options fundamentals (calls, puts, Greeks), technical analysis (option chain analysis, volatility indicators), and Nifty-specific strategies (bull call spread, strangles, iron condors).

Practical Training: Live trading sessions where students apply Nifty option trading strategies in real-time Nifty markets.

Student-Friendly: Affordable pricing with flexible payment plans to fit student budgets.

Mentorship: One-on-one guidance from experienced traders to address individual queries.

Certification: Industry-recognized certificate to boost career prospects.

Duration: 8 weeks, with 2–3 hours of weekly live classes plus recorded content for revision.

Community Support: Access to forums and Q&A sessions for peer learning and ongoing support.

Why Choose This Course? Shaan Trade’s course is ideal for Nifty trading beginners, combining theoretical insights with hands-on practice. Students learn to analyze Nifty option chains, interpret Greeks (e.g., Delta, Theta), and execute trades in volatile conditions. The course’s affordability, live market exposure, and mentorship make it a top choice for mastering Nifty option trading strategies. By focusing on practical skills, Shaan Trade ensures students can confidently implement stock market options strategies.

Price: Approximately INR 15,000–18,000 (check Shaan Trade’s website for discounts).

Top Nifty Option Trading Strategies

Here are five of the Nifty option trading strategies taught in Shaan Trade’s options trading course, with examples tailored to the Nifty 50 index:

1. Bull Call Spread

What It Is: Buy a call option at a lower strike price and sell a call at a higher strike to reduce cost, betting on a moderate Nifty rise.

When to Use: Moderately bullish outlook (e.g., post-positive economic data).

Example: Buy Nifty 22,000 call for INR 200 and sell 22,200 call for INR 80. Net cost: INR 120 per lot (50 units). Max profit if Nifty reaches 22,200.

Risk: Limited to net premium paid.

Why It Works for Nifty: Cost-effective for students, leveraging Nifty’s frequent uptrends.

2. Long Strangle

What It Is: Buy an out-of-the-money call and put with different strike prices, betting on significant Nifty movement.

When to Use: Before high-volatility events (e.g., budget announcements).

Example: Buy Nifty 22,100 call (INR 90) and 21,900 put (INR 80). Total cost: INR 170 per lot. Profit if Nifty moves beyond 22,270 or 21,730.

Risk: Limited to premium paid; high time decay.

Why It Works for Nifty: Nifty’s volatility during events creates opportunities.

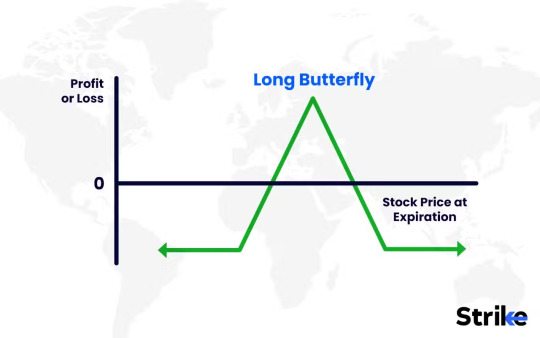

3. Iron Condor

What It Is: Sell an out-of-the-money call and put, and buy further out-of-the-money call and put to limit risk, earning premiums in a range-bound market.

When to Use: Stable Nifty range (e.g., 21,800–22,200).

Example: Sell Nifty 22,200 call (INR 50) and 21,800 put (INR 40), buy 22,400 call and 21,600 put for protection. Net premium: INR 90 per lot.

Risk: Limited to difference between strikes minus premium.

Why It Works for Nifty: Nifty’s consolidation phases suit this strategy.

4. Bear Put Spread

What It Is: Buy a put option at a higher strike and sell a put at a lower strike, betting on a moderate Nifty decline.

When to Use: Bearish outlook (e.g., post-negative global cues).

Example: Buy Nifty 22,000 put for INR 150 and sell 21,800 put for INR 60. Net cost: INR 90 per lot. Max profit if Nifty falls to 21,800.

Risk: Limited to net premium paid.

Why It Works for Nifty: Protects against sharp declines with low capital.

5. Short Straddle

What It Is: Sell a call and put at the same strike price, betting on minimal Nifty movement.

When to Use: Low volatility periods (e.g., post-earnings stability).

Example: Sell Nifty 22,000 call and put for INR 100 each. Total premium: INR 200 per lot. Profit if Nifty stays near 22,000.

Risk: Unlimited if Nifty moves significantly.

Why It Works for Nifty: High premiums during stable periods benefit sellers.

Shaan Trade’s options trading course teaches these Nifty option trading strategies with live Nifty market examples, ensuring students understand their practical application.

How to Start Nifty Options Trading as a Student

Enroll in Shaan Trade’s Course: The Nifty Options Trading Course is perfect for learn Nifty trading beginners.

Open a Demat Account: Use platforms like Zerodha or Upstox for low-cost Nifty options trading.

Practice with Paper Trading: Test Nifty option trading strategies on virtual platforms to build confidence.

Start Small: Trade one Nifty lot (50 units) to minimize risk.

Stay Informed: Follow SEBI regulations and Nifty news via Moneycontrol or Shaan Trade’s resources.

Challenges Students May Face

Time Management: Balancing academics and trading is challenging. Shaan Trade’s flexible options trading course with recorded content helps.

Financial Constraints: Shaan Trade’s affordable pricing and free webinars reduce barriers.

Market Volatility: Nifty’s swings can be risky. Shaan Trade teaches risk management to protect capital.

Learning Curve: Options Greeks can be complex. Shaan Trade simplifies concepts for stock trading for beginners.

Tips to Excel in Nifty Options Trading

Master Option Chain Analysis: Read implied volatility and open interest to time trades effectively.

Prioritize Risk Management: Use stop-loss orders or hedging to limit losses.

Understand Greeks: Study Delta, Theta, and Vega to predict option behavior.

Backtest Strategies: Test Nifty trading plans on historical Nifty data.

Stay Disciplined: Avoid overtrading during volatile Nifty sessions.

Why Shaan Trade is the Best Choice for Nifty Trading

Shaan Trade’s options trading courses excel for learn Nifty trading students due to:

Practical Focus: Live Nifty trading sessions bridge theory and practice.

Affordable Pricing: Fits student budgets without compromising quality.

Expert Mentorship: Instructors with Nifty market expertise provide actionable insights.

Community Support: Forums and Q&A ensure continuous guidance.

These features make Shaan Trade the top provider of Nifty option trading strategies education.

Conclusion

The Nifty option trading strategies taught by Shaan Trade empower students to navigate stock market options with skill and confidence. From bull call spreads to iron condors, Shaan Trade’s options trading course equips learn Nifty trading beginners with practical strategies for the Nifty 50 index. With affordable pricing, live market exposure, and expert mentorship, Shaan Trade is the ideal choice for students seeking Nifty trading success. Enroll in Shaan Trade’s Nifty Options Trading Course today and unlock the potential of Nifty options!

Disclaimer: Options trading involves risks, and past performance is not indicative of future results. Consult a financial advisor before trading.

0 notes

Text

📢 Golden Crossover: Your Secret Weapon for Market Profits | Parkavi Finance

🏆 Swing Trading-க்கு Golden Crossover எப்படி பயனாகும்? 📊 EMA 100 & EMA 200-ஐ Pine Script மூலம் Backtest செய்வது எப்படி? 🔹 HDFC Life & Nifty-ல் Entry & Exit Points 🔹 TradingView-ல் Pine Script Code Paste செய்வது எப்படி? 🔹 Risk Management, Stop Loss & Time Frame பற்றி தெரிந்து கொள்ளுங்கள் 🔹 Gemini AI மூலம் Pine Script Strategy Build செய்யலாம் 🔹 Parkavi Finance Trading Workshop பற்றிய தகவல் பெற!

⏰ Timeline: 🔸 00:00 - Intro | Swing Trading | Social Message 🔸 01:28 - Golden Crossover என்றால் ��ன்ன? 🔸 02:07 - EMA 100, EMA 200 Days Pine Script Strategy | Gemini AI பயன்படுத்தி 🔸 02:37 - TradingView-ல் Pine Script Paste செய்வது எப்படி? 🔸 03:14 - HDFC Life Insurance Backtest (Entry & Exit) 🔸 04:39 - Risk Management & Stop Loss 🔸 05:25 - Time Frame & Nifty Backtest (EMA 100 & EMA 200) 🔸 06:48 - CTA | Parkavi Finance & Trading Workshop Info

📌 Additional Resources: 🎥 Watch Now: 👉 https://youtu.be/ySwpWMzUOlk 📖 Read in Tamil: 👉 https://tamilparkavifinance.blogspot.com/2025/04/golden-crossover-your-secret-weapon-for.html 📖 Read in English: 👉 https://www.parkavifinance.com/2025/04/golden-crossover-your-secret-weapon-for.html 🎥 Watch Now: 👉 https://youtu.be/IsK7__WuKE0

🚀 Parkavi Finance Trading Workshop-ஐ பற்றிய தகவல்களும் இதில் இருக்கும்! 🔹 Swing Traders & Technical Traders தவறாமல் பாருங்கள்! 🔹 #BuyIndianProducts – Indian Stocks-ஐ Support செய்யுங்கள்!

📌 Hashtags: #SwingTrading #GoldenCrossoverStrategy #SwingTradingTamil #PineScriptTradingStrategy #HDFCLifeStockAnalysis #TradingViewSwingTrading #RiskManagementInTrading #PineScriptTamil #BestGoldenCrossoverStrategy #BacktestingTradingStrategy #SwingTradingForBeginners #NiftyTradingWithPineScript #BestRiskManagementTechniques #GeminiAIForTrading #BuyIndianProducts #TradingViewPineScript #NiftyBacktestingStrategy #TechnicalAnalysisTamil #TradingStrategyTamil #IndianStockMarket #EMA100vsEMA200Crossover

0 notes

Text

Free Backtesting

#freebackktesting#backtest#backtesting#freebacktest#niftybacktesting#optionbacktesting#freeoptionbackteting#bankniftybacktesting

1 note

·

View note

Text

Midcap Nifty: Unlocking the Growth Potential of India's Mid-Sized Companies

Midcap Nifty stands as a pivotal index for investors seeking a balance between stability and growth. Representing the performance of India’s mid-cap companies, it offers an attractive alternative to large-cap and small-cap investments. Let’s explore why Midcap Nifty could be the key to building a robust portfolio.

What is Midcap Nifty?

Midcap Nifty is an index that tracks the top-performing mid-cap companies listed on the National Stock Exchange (NSE). These companies typically have market capitalizations between ₹5,000 crores and ₹20,000 crores. As businesses in their growth phase, they strike a balance between high potential returns and moderate risk.

Features of Midcap Nifty

Diverse Sector Representation: The index includes companies from industries such as IT, healthcare, manufacturing, and finance, offering a diversified investment option.

Dynamic Growth Opportunities: Mid-cap companies are often at the forefront of innovation and expansion, providing investors with unique opportunities for wealth creation.

Liquidity and Accessibility: Stocks within the index maintain adequate trading volumes, making them easily accessible for retail and institutional investors alike.

Why Choose Midcap Nifty?

Growth-Oriented Investments: Mid-cap companies are in the sweet spot of business growth, offering higher return potential compared to large caps.

Better Value: Many mid-cap stocks are undervalued gems, providing a chance for investors to capitalize on their growth stories before they become mainstream.

Portfolio Diversification: Including Midcap Nifty in your portfolio ensures exposure to mid-sized companies that can thrive in various economic conditions.

Risks to Consider

Higher Volatility: Mid-cap stocks are more prone to price swings than large caps.

Economic Sensitivity: Mid-cap companies can face challenges during economic downturns due to limited resources.

Lower Visibility: These companies may receive less coverage, requiring deeper research for informed investments.

How to Invest in Midcap Nifty

Index Funds and ETFs: These provide an easy and cost-effective way to gain exposure to the Midcap Nifty index.

Direct Stock Selection: Investors can handpick stocks from the index to build a customized portfolio.

Systematic Investment Plan (SIP): A disciplined SIP approach can help manage risks and average out market volatility over time.

Leveraging Tradetron for Midcap Nifty

Tradetron, a leading algorithmic trading platform, simplifies your investment journey:

Automated Strategies: Use predefined strategies to automate your trades.

Customizable Algorithms: Create algorithms tailored to your risk tolerance and goals.

Backtesting Capabilities: Test strategies against historical data to optimize performance.

Real-Time Alerts: Stay informed about market changes and opportunities.

Midcap Nifty in the Indian Economy

Reflection of Growth Sectors: The index captures the performance of industries driving India’s economic progress.

Potential for Outperformance: Historically, mid-cap indices have delivered higher returns during economic upswings.

Focus on Innovation: Many mid-cap companies invest in research and development, paving the way for long-term success.

Tips for Investing in Midcap Nifty

Research and Analysis: Understand the fundamentals of the companies in the index.

Diversify: Combine Midcap Nifty with large-cap and small-cap investments for a well-rounded portfolio.

Adopt a Long-Term View: Mid-cap investments often require patience to realize their full potential.

Conclusion

Midcap Nifty represents a promising segment of the Indian stock market, offering a compelling mix of growth potential and moderate risk. With the power of advanced tools like Tradetron, investors can craft strategies to make the most of this dynamic index. Whether you're building wealth for the future or seeking diversification, Midcap Nifty deserves serious consideration in your investment plan.

0 notes

Text

"Indian Trading Mart: Pioneering Advanced Technology Solutions for Profitable Trading in the Indian Market"

Indian Trading Mart is India's leading software provider company that provides services for the stock market, share market, intraday trading, bank nifty, and nifty 50. With its headquarters in Bengaluru, Karnataka, Indian Trading Mart offers an automated robot setup with expert-managed trading accounts, ensuring a profitable trading experience for its clients.

The company uses advanced technology and resources like Trading view for charting, and Manage Engine for server monitoring. Its team of experts develops algorithms using popular programming languages like .Net, Java, MatLab, Python, and C++, to provide efficient and accurate trading solutions.

It is important to note that Indian Trading Mart does not provide trading tips or act as investment advisors. Its services are limited to the development, deployment, and maintenance of automated trading applications. The algorithms used are based on backtested data, however, the company does not guarantee their future performance.

Before deployment, the algorithm running in an automated system is agreed upon with the user and Indian Trading Mart does not take any liability for any profit or loss generated by the same. Past performance of strategies or advice does not guarantee future performance and actual returns may differ significantly.

The company also highlights that there is no assurance or guarantee that the objectives of any strategy or advice provided by Indian Trading Mart will be achieved. The value of investments can go up or down depending on various factors and forces affecting the securities market. Therefore, the company and its associates are not liable for any losses arising from market conditions.

In conclusion, Indian Trading Mart offers reliable and advanced technology-driven solutions for trading in the Indian market. With its experienced team and efficient algorithms, it aims to provide a profitable trading experience for its clients. However, investors need to understand the risks involved and make informed decisions. For more information, visit the company's website and read its terms and conditions and privacy policy.

0 notes

Text

#backtesting#nifty#nifty50#banknifty#option trading tips#option trading strategy#option backtesting#options#nifty today

1 note

·

View note

Text

How to start building a Trading Strategy

One of the most important tasks for any trader is to devise an effective trading strategy. A well-thought-out strategy provides the framework and rules for entering and exiting trades in a systematic manner. This helps traders make objective, emotionless decisions and take a business-like approach to the markets.

However, building a trading strategy from scratch can seem like an overwhelming process, especially for new traders. Where does one even begin?

In this article, we will provide a step-by-step guide to understanding different types of trading styles and getting started with developing your own custom trading approach.

Opening a Trading Account

The first step in trading is to open a live trading account with a reputable brokerage firm. Brokers in India like Zerodha, Upstox, etc. offer easy to use online platforms to place orders. Most investors maintain separate accounts for trading and long-term investing.

What is a holding period?

Understanding the concept of the holding period is important in creating a trading strategy. Holding period refers to the length of time an asset is held or maintained in an investment portfolio before being sold. It indicates how long an investor intends to own securities or positions before liquidating them.

Pointers to build an effective trading strategy

Choose the Type of Trading Style

There are different styles like day trading, swing trading, and position trading based on holding period. Analyze which style complements your risk profile, other commitments, and market knowledge. For beginners, longer holding styles like position trading may be better than trying to capture small intraday movements.

Focus on a Few Instruments

Rather than darting around in multiple securities, focus your research on the 2-3 most liquid stocks or indices. Markets like Nifty50, Bank Nifty may be suitable for new traders given their high volumes Remember, patience is key when trading and too many positions might increase the level of risk.

Define Trading Plan and Rules

Backtest strategies on historical price data and outline clear entry, exit and stop-loss rules before trading actual money. Document procedures for taking new positions, scaling out profits and cutting losses. Define risks and returns expected over different holding periods.

Use Technical Indicators

Technical analysis studies patterns in prices and volumes. Common tools include moving averages, Bollinger Bands, RSI, and candlestick patterns for identifying potential reversals and breakouts on charts. Factor them into your trading plan.

Learn Price Action Patterns

Along with indicators, study basic candlestick and line chart patterns that denote demand and supply zones in an instrument. Signs of accumulation and distribution by big players can help you spot potential areas of support and resistance on charts.

Trade Simulators for Practice

Most brokers offer virtual trading that allow you to test strategies on historical price data without actual funds. Treat demo accounts seriously for months to learn weaknesses in your trading psychology before going live with real money.

Review Performance Regularly

Traders must analyze both winning and losing trades to see what worked and what constant improvements are needed. Track metrics like average win/loss, hit ratio, drawdowns over time to assess a strategy's risk-adjusted performance objectively.

Remain Patient and Disciplined

Rome was not built in a day. Give strategies time to play out as per plan and stick to risk management rules without emotions swaying your decisions. Only then can one methodically build capital over the long run.

Conclusion

By following these systematic steps, traders can organically develop a customized trading style that aligns with their abilities and market conditions. Remember, proficiency comes with practice, constant evaluation, and honing your strategy over time.

1 note

·

View note

Text

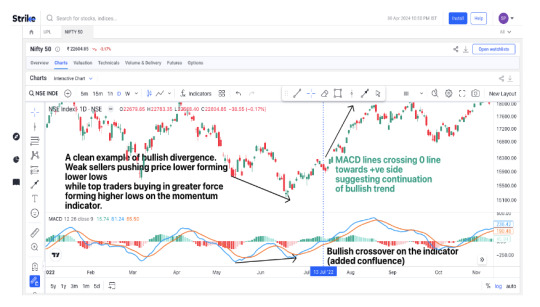

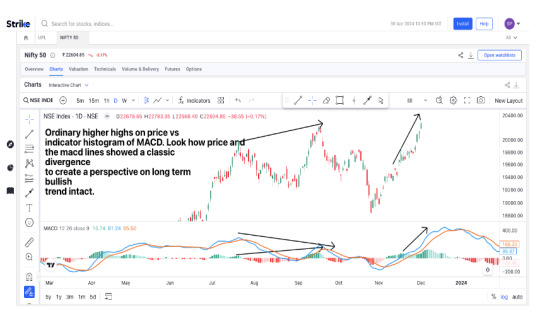

Divergence in Trading: The Signal Most Traders Ignore—Here’s Why You Shouldn’t 👀

Divergence occurs when the price of a security moves in the opposite direction of a technical indicator—usually momentum-based. 📊 It’s a powerful concept in technical analysis, frequently signaling that a trend is losing strength. While it might sound simple, divergence is often the early warning traders overlook before major reversals.

Technical legends like Charles Dow and John Murphy have emphasized divergence for decades. From Nifty 50 to Bitcoin and EUR/INR, this tool is used across markets to anticipate reversals or trend continuations with surprising accuracy.

Regular, Hidden & Exaggerated Divergence—Decoded for Humans 🤔

Understanding the type of divergence is essential.

🔹 Regular Divergence: Seen at trend reversals. For example, when price makes a new low but RSI makes a higher low, it’s a bullish divergence—hinting at a potential bottom. 🔹 Hidden Divergence: Seen during trend continuation. If price makes a higher low but the MACD makes a lower low, the uptrend may continue. 🔹 Exaggerated Divergence: Price forms equal highs or lows, but the indicator shows a noticeable deviation. It's rare but powerful.

Strike Money, a modern Indian charting tool, helps visualize these divergence patterns on major Indian stocks, making them easier to spot and backtest.

Bullish vs Bearish Divergence on Nifty 50: Real Charts, Real Signals 📈

📌 Example – February 2025: Nifty 50 dipped to 22,800. However, RSI didn’t confirm the lower low—it instead made a higher low. This bullish divergence was flagged on charting tools like Strike Money and later followed by a rally to 23,200 within two sessions—a 1.7% move.

📌 March 2025: Price made higher highs, but RSI made a lower high. This bearish divergence predicted a 300-point drop within hours.

These scenarios show why recognizing bullish and bearish divergence early can make or save your trading day.

RSI, MACD & Stochastic—The Trio That Exposes Divergence Faster ⚙️

Let’s break down the best indicators to catch divergence quickly:

⚡ RSI (Relative Strength Index): Frequently used to detect both regular and hidden divergence. In Indian stocks like Tata Motors and Infosys, RSI divergences often form around the 30–70 levels, providing early reversal clues.

⚡ MACD (Moving Average Convergence Divergence): Especially effective on longer timeframes. Back-tested results show MACD divergence offers better accuracy when paired with moving averages.

⚡ Stochastic Oscillator: Offers earlier signals than RSI or MACD. However, it’s more sensitive and prone to false positives—best for short-term setups on liquid stocks like HDFC Bank.

Using all three together creates a consensus approach. If two or more indicators confirm divergence, the probability of success rises significantly.

Strike Money Walk-Through: Spot Divergence in Seconds 🖥️

Modern traders need speed and accuracy. That’s where Strike Money steps in.

🔍 Open a stock chart—say, Reliance Industries. Use the "Divergence Finder" feature. The tool overlays RSI and MACD swing points and flags potential bullish (🟢) or bearish (🔴) divergences automatically.

📈 Example: On April 5, 2025, Strike Money highlighted bullish RSI divergence in Reliance. The price moved up 3.2% in just four sessions—outperforming even a passive buy-and-hold approach during that period.

By combining chart recognition with historical win-rate analysis, Strike Money transforms divergence from theory into actionable insight.

Forex, Crypto & Stocks—Divergence Strategies That Travel Well 🌍

💱 Forex (EUR/INR): Around RBI policy announcements, divergence signals often emerge hours before price reacts. Regular bearish divergence has consistently preceded rupee weakness against the euro.

🪙 Crypto (Bitcoin/INR): In April 2025, Bitcoin formed a hidden bullish MACD divergence near ₹46 lakh. It surged to ₹49 lakh within days. Traders using divergence were in ahead of the breakout.

📈 Indian Stocks: Divergence plays out beautifully in high-volatility stocks. In mid-caps, where price action often overshoots on earnings news, divergence signals offer a safer entry or exit.

Regardless of the asset, divergence is grounded in the universal principle of momentum versus price—making it market-neutral and widely applicable.

Proof in Numbers: What Research Says About Divergence Accuracy 📊

🔬 A 2024 study on Nifty 50 stocks (2015–2023) showed RSI divergence produced an average 57 basis point edge per signal. Larger cap names like Reliance and Infosys saw more consistent results due to better liquidity.

🔬 Another Indian study on BSE IT stocks found that MACD divergence combined with a 20-day moving average filter reduced false signals by nearly 33%.

🔬 Global back-testing across various exchanges reported MACD divergence had an 81.4% win rate historically with a 1.5 profit factor—but real-time execution reduces that edge due to slippage and transaction costs.

The takeaway: divergence works, but only when combined with sound strategy and market context.

Avoid These Common Divergence Traps 😱

🚫 Trading every divergence: Not every divergence is trade-worthy. Focus on those with clear structure and volume confirmation.

🚫 Ignoring volume: If divergence isn’t supported by rising volume, it’s likely noise. For example, divergence during low-volume sessions in ITC often fizzles out.

🚫 Over-leveraging: Divergence is a signal, not a guarantee. CFTC and SEC data shows that over 40% of retail trading losses are due to over-leveraged positions—even when entry signals are correct.

Discipline, not just divergence, protects your capital.

Confirmation Tools You Cannot Ignore 🔑

🔑 On-Balance Volume (OBV): When price forms a low but OBV rises, it confirms bullish divergence with real buying.

🔑 Candlestick Patterns: A hammer after a bullish divergence or a shooting star after a bearish divergence can tighten your entry timing.

🔑 Moving Averages: If price crosses the 20-day EMA after divergence confirmation, the move is likely to gain momentum.

Combining divergence with these tools builds a stronger case for entry or exit.

Divergence in Indian Stocks: Case Studies That Hit Home 💹

📉 Infosys – October 2024: Bearish MACD divergence on the daily chart formed while price peaked near ₹1,550. Over the next 12 sessions, it dropped to ₹1,410—an effective early warning for those holding long positions.

📈 Tata Steel – January 2025: A bullish RSI divergence followed a sharp correction to ₹117. Within two weeks, it rallied to ₹130—delivering a 10% swing.

📉 Bajaj Finance – March 2025: Bearish RSI divergence preceded a sharp 5% intraday drop following surprise rate-hike commentary. Divergence had shown up a day earlier for those watching.

These examples underline that divergence doesn’t just work—it works especially well in trending or overextended stocks.

Final Word: Should Divergence Guide Your Next Trade? 🏁

Divergence is a time-tested signal that quietly hints at big moves—if you know how to listen. It's not a standalone system but a high-probability clue in a world of market noise.

📊 Used with indicators like RSI, MACD, and Stochastic, supported by confirmation tools like volume, candlestick patterns, and moving averages, it becomes a sharp weapon in a trader’s arsenal.

🧠 The key lies in discipline—avoid chasing every alert, focus on well-formed divergence supported by market structure, and never over-leverage.

With tools like Strike Money, identifying and backtesting divergence is easier than ever for Indian traders. When combined with strong risk management and market understanding, divergence can quietly become your most trusted trading signal.

0 notes

Link

We recently introduced a new feature on algotest.in called Portfolio, which allows you to backtest multiple strategies together. In this blog, we’ll backtest a sample portfolio of multiple strategies, and also show you how to avoid common pitfalls when using this feature.

#free backtesting software#options backtesting india#free backtesting software india#nifty option backtesting#backtest trading strategy

0 notes

Text

0 notes